Last month we shared the first data from our Weather Report, where we’re taking data weekly out of FALCON and using it to give a real-time look at the WordPress industry.

We didn’t share any breakdown of the data last time. WordPress and WooCommerce have fairly different trajectories and fortunes. WooCommerce has grown hugely through the pandemic -– but so did Shopify, and Shopify’s share price right now is as though the last 2 years never happened.

We can split out WordPress and WooCommerce topics, and see their differing trajectories. WooCommerce has been a lot stronger than WordPress this year.

This is an 8-week rolling average, so at the start of 2022 we’re still coming down off a Black Friday high. Growth does dip to negative in April and May, but the WooCommerce dip is smaller and over faster than WordPress’:

WooCommerce is therefore in a stronger position than WordPress, but growth has slowed this year. This has led WooCommerce product makers to look for new sales channels as their active ones performed less.

If you’re looking for new sales channels, then definitely get in touch with us for a no-obligation look at your opportunities.

70% commission on sales makes the WooCommerce Marketplace a viable sales channel

The WooCommerce Marketplace is the official sales source for WooCommerce Extensions. First party extensions from Automattic, including key parts of WooCommerce like WooCommerce Subscriptions, are sold there alongside products from third party developers.

For a long time the Marketplace was not popular with third party developers. Developers knew they could sell on their own sites and control their destiny. The most successful product businesses, like Barn2, worked with us to drive thousands of purchase-intent visitors to their site each month from organic search.

The deal used to be that if you sold exclusively on the WooCommerce Marketplace, you got a 70% commission. If you sold on your own site as well, you only got a 30% commission from the Marketplace. This put a lot of sellers off.

WooCommerce rightly, in my opinion, realised they could get better product inventory if they scrapped the dual commission structure. Last year they changed the commission to a flat 70% for everyone. This makes the WooCommerce Marketplace a viable sales channel for any WooCommerce product.

The question is: is listing going to get you any sales?

$85,498,900 in estimated revenue from the WooCommerce Marketplace

One of our clients gave me a heads-up recently that Marketplace listings now include an active install count. I assume this was done to give buyers more information about how popular a plugin is, similar to WordPress.org.

This also lets us very loosely estimate revenue from a product, as we can multiply the active install count by the listing price. This is, to be clear, an incredibly imprecise method.

Sales ≠ active installs, and we don’t know how accurate the active install number is. It could be over or under-counting. We also don’t know what % of the active installs are as a result of Marketplace sales.

Caveats out the way, it does give us a rough guide to what’s going on, on the Marketplace.

WooCommerce Subscriptions is by far the most popular product, with 3.5x the estimated revenue of the second most popular plugin.

All of the top 5 highest grossing products have estimated revenue over $2m. 4 of those are made by WooCommerce. The extent to which the “first mover” advantage is real is quite remarkable. For many years the Marketplace was closed to new sellers, and only WooCommerce and a small number of approved sellers were permitted to sell.

SkyVerge, now owned by GoDaddy, was one of the early sellers. Another was Prospress, who were bought by WooCommerce in 2019. Prospress developed WooCommerce Subscriptions and I suspect that deal looks like a bargain now.

WooCommerce directly make approximately ⅓ of the products on the Marketplace, and are taking most of the revenue. The products made by those original 3 sellers – SkyVerge, Prospress, and Woo – make up ~75% of the estimated Marketplace revenue.

They’ve had many many years to build those active installs, so this isn’t surprising. The important question is to what extent the remaining 25% of revenue constitutes a worthwhile marketing channel for WooCommerce product makers, now.

Can new listings get traction?

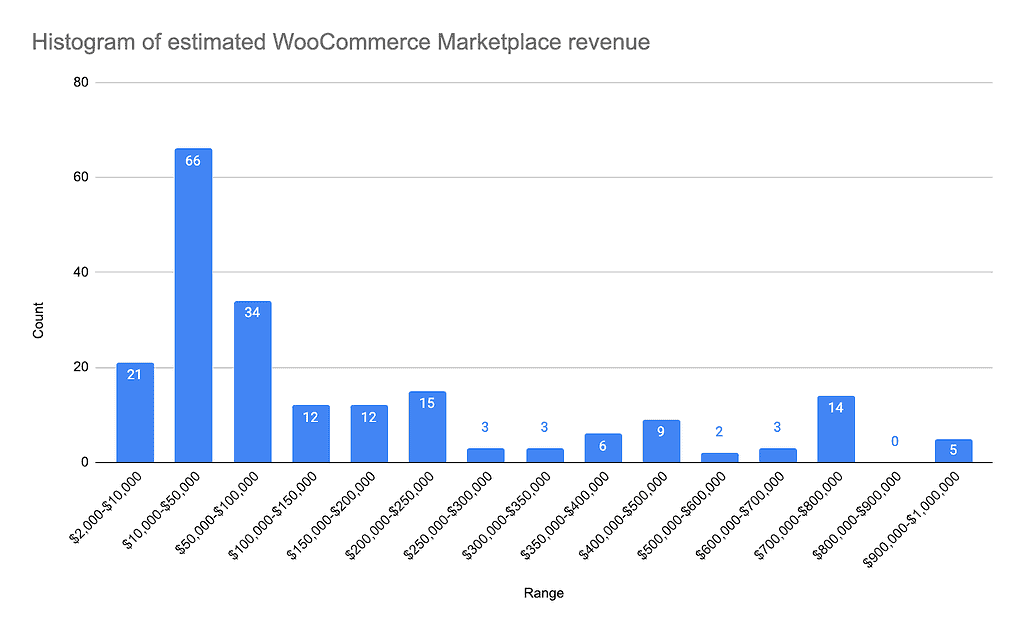

The answer is: maybe. I’ve excluded the top 10% to make the graphs more readable. The average plugin is grossing an estimated $10k to $100k all-time from the Marketplace. You can see this from the histogram below, which shows the frequency with which each value shows in the dataset:

Obviously, $10-100k is nice to have. It’s worth noting that we don’t know how long these have been listed – $100k in 6 months is great, but $10k in 5 years is less impressive. We’re also not seeing how many products make no sales, as they won’t show up in the dataset.

41% of products on the Marketplace are free (and likely monetise in other ways), so we’re also not seeing this revenue.

Our recommendation here is an “it depends”: I’d talk to the Marketplace team and get an understanding of what demand they’re seeing. That insight along with the context of your plugin and its place on the Marketplace will be helpful in identifying the true potential. I know first-hand the team have extremely helpful in supporting businesses navigate the business decisions necessary.

The role of the official Marketplace as a central sales channel is also not to be ignored: there is revenue on the table here. It’s healthy for the ecosystem for the Marketplace to be competitive and thriving, and in the long run I can see this being much more important.

It’s not a gold-rush in the way we saw with something like Themeforest a couple of years back, though. Listing – or not – on the Marketplace can be a solid earner for WooCommerce product makers, but our revenue estimates from the active install data show you’re likely to get a solid earner, rather than a breakout hit.

This means that the decision to list needs to be part of a balanced marketing strategy. For that, you’d obviously better talk to us.